$250K Growth in 3 Years!

Build Wealth Through Property Without the Guesswork

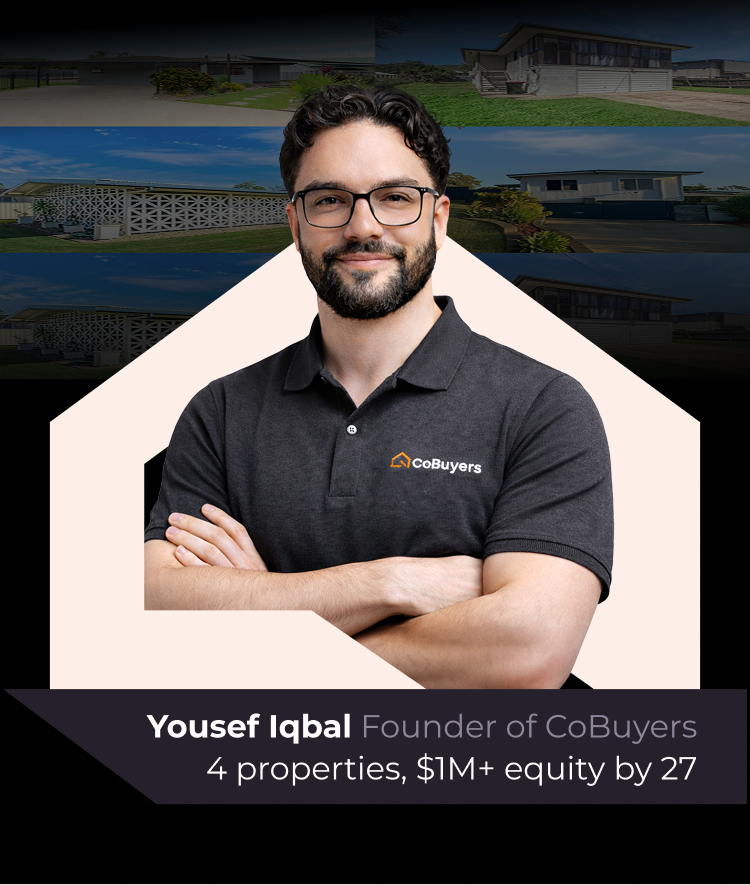

Hi, I'm Yousef 👋

Then a friend introduced me to property.

With an engineering background, I knew there had to be a way to apply data to investing, not just gut feel and chasing the latest hotspot the media is promoting (only after it’s seen growth). So I built my own system: an algorithm that weighted 15–25 data factors across 15,000+ suburbs.

It worked. I found my first property. But I made one mistake. I hired a "big name" buyer's agent. Paid big bucks. What I got sent was a property they found on realestate.com.au - not off-market, no transparency, no data, no explanation of why that property over any other.

I'd paid for a search I could've done myself.

That was the turning point. I backed myself, bought a new property using my own research, and made a 30% gain in one year.Friends noticed. They asked for help. Word spread. In 2023, I launched CoBuyers.

Today I own four properties worth over $1M in equity at 27. Not because I bought 20 properties. Because I bought the right ones.

Now I help other busy Australians do the same.

The numbers speak

Data-driven, not sales-driven

The biggest complaint about buyer’s agents?

You never see the logic behind their recommendations.

26% Growth in 12 Months!!

25% Avg. Growth per Year

28% Avg. Growth per Year

250K Growth in 3 Years!!

You're spending $500k+ and flying blind.

I do it differently.

Is this the right move for you?

This is for you if:

This probably isn't for you if:

What You Get When

You Work With Me

Full-service property acquisition for $10,000 inc GST.

You're paying for me - one person who does the work, knows the data, and is accountable for your result.

Here's what that includes:

Frequently Asked

Questions

I've been researching for months and I'm more confused than when I started. How is this different?

That’s exactly why most of my clients come to me. YouTube says one thing, a broker says another, your mate reckons he knows a hot suburb and you end up stuck. I cut through the noise with a data-driven system that ranks 15,000+ suburbs across 25 weighted factors. No opinions. No guesswork. Just numbers that tell us where to look and why.

How do I know I won't overpay or buy a dud?

Two things protect you. First, my research process filters out the duds before you ever see them. I’m looking at supply constraints, growth drivers, rental demand, flood zones, and dozens of other factors. Second, I negotiate hard. If something comes up in the building and pest, I either negotiate the price down or tell you to walk away. I’m not here to close a deal. I’m here to get you the right deal.

I don't know how to read data or project cashflow. Do I need to?

No. That’s my job. But unlike other buyer’s agents, I don’t keep you in the dark. You’ll see the data, the modelling, and the reasoning behind every recommendation. I educate you through the process so you understand why we’re targeting a suburb, not just “trust me, it’s good.”

I feel like every month I wait, I'm losing money. But I'm also scared to rush.

I get it. Prices are rising, your mates are buying, and the media makes it sound like you’ve already missed the boat. The worst thing you can do is panic-buy the wrong property. The second worst thing is stay frozen. My job is to get you moving with confidence, quickly, but not recklessly.

I've heard horror stories about buyer's agents pushing properties just to get paid. How do I know you're not doing that?

Because you see everything. I give you a live spreadsheet with every property I’m considering: data, notes, video walkthroughs. You’re not shown one option and told to take it. You see the full picture and we make the decision together. I also don’t get kickbacks from developers or agents. My only incentive is to find you the right property.

I don't have time to research suburbs, attend open homes, and chase agents. Can you actually handle all of that?

Yes. That’s the point. You sign the contract and I handle everything else. Strategy, research, shortlisting, negotiating, coordinating inspections, liaising with conveyancers, even lining up property managers. Most of my clients are busy professionals who want the outcome without the 6-month research spiral.

I'm priced out of Sydney. Does that mean I've missed my chance?

Not at all. Most of my clients are Sydney-based and can’t afford to buy there. That’s where rentvesting comes in: you rent where you want to live, and invest where the numbers make sense. I’ve helped clients buy high-growth properties in QLD, VIC, and WA for under $500k and some of those have gained $200k+ in two years. You don’t need Sydney prices to build serious wealth.

What if I can only afford one property, is it still worth working with you?

Absolutely. In fact, getting the first one right is the most important decision you’ll make. A well-chosen first property becomes the foundation for everything else. It grows, you extract equity, and you use that to buy the next one. I also map out your long-term strategy from day one, so even if you’re starting with one, you’ll know exactly how to scale.

Why are you cheaper than other buyer's agents?

Because you’re not paying for a sales team, a CBD office, or someone’s advertising budget. You’re paying for me – one person who does the research, finds the property, and negotiates the deal. I’ve systemised the process so I can deliver more value without the overhead. $10k flat, everything included.

What happens on the discovery call?

It’s a chance for us to see if we’re a good fit. I’ll ask about your goals, budget, and timeline. You can ask me anything. No pressure, no pitch, just a conversation to see if working together makes sense.